Keypasco are happy to announce the release of the new and improved version of Borgen™. This release addresses many of the things customers have requested to get an even better and more easily managed security tool. Keypasco has now reached over 2 million active users. With good growth in many different application areas, the number […]

Continue readingCategory Archives: New Feature

Public Sale starts today – Keypasco ICO update

When well-established Swedish IT security company Keypasco first heard of ICOs they quickly decided that this was something new and exciting they just had to learn more about – and the best way to learn is to try it yourself. And now after an intense period of preparation, and an extensive private sales road show […]

Continue readingKeypasco expands to Blockchain

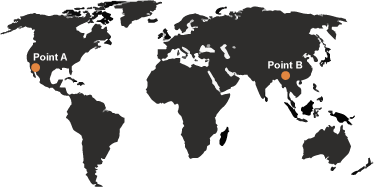

The Swedish IT security company Keypasco has been working in the field of online authentication since 2010, providing its unique patented solution to millions of end-users worldwide. To expand in to the future Keypasco are now developing their solution in to the world of blockchain. With a clear goal set – to secure all virtual […]

Continue readingPSD2 – Strong Customer Authentication

In February 2017, the European Banking Authority (EBA) published the final draft of the Regulatory Technical Standards on Strong Customer Authentication and Common and Secure Communication under the revised Payment Services Directive (PSD2). Maybe not the most selling title, but it is nevertheless important that your services use a security solution that meets the requirements. […]

Continue readingAre your services PSD2 compliant?

Maybe you already have full control of PSD2, and what it means for you, and your business? If not, no need to worry. Our security solution is PSD2 compliant! We put together a short summary of the new regulation to give you an overview of what it’s all about. What is PSD2? The EU Payment […]

Continue readingThe new road to Internet security

Over the years, reports have been pouring in about leaked account information, stolen passwords, credit card fraud and other troublesome and costly incidents, all due to poor security solutions. Now, the Swedish company Keypasco has come up with a solution that could revolutionize how we address the security problem. Internet security is an on-going problem […]

Continue readingAsia’s first all-in-one smart home app launched — in collaboration with world class security by Keypasco

Habitap, Asia’s first fully integrated smart home management system, is now officially launched. The system seamlessly combines smart home features, smart condominium management as well as lifestyle offerings to provide solutions for holistic smart home living. The high security that is crucial for smart home is obtained through the Keypasco solution. Leading the way in […]

Continue readingKeypasco are happy to announce a new product feature at the CARTES Exhibition in November 2015. This new feature is a natural extension of the secure authentication and secure mobility solution offering secure signatures in a PKI solution.

Keypasco are happy to announce a new product feature at the CARTES Exhibition in November 2015. This new feature is a natural extension of the secure authentication and secure mobility solution offering secure signatures in a PKI solution. Let me introduce the Keypasco PKI Sign feature. The PKI Sign solution is a dynamic feature that […]

Continue reading