Don’t Assume 2FA Makes You Safe! Hackers Have Evolved — Here’s Why MFA Is a Smarter Move As awareness of online security grows, more users are enabling two-factor authentication (2FA) on their digital accounts. Whether it’s for social media, online banking, or shopping platforms, many services now recommend turning on 2FA to protect your personal […]

Continue readingCategory Archives: Keypasco Solution

My Number Meltdown: Japan’s Unprecedented National ID Data Breach

Japan is in the midst of a data security crisis. According to a recent government report, personal data breaches in the country have skyrocketed by 58% in 2024, hitting a record-breaking 21,007 reported cases — the highest number since official records began. One of the most alarming parts of this report involves Japan’s national identification […]

Continue readingTaiwan’s Hospitals Under Fire: Why Zero Trust Is the New Lifeline for Medical Cybersecurity

Taiwan’s healthcare system is under siege. In just the past two years, a wave of cyberattacks from insider data abuse to devastating ransomware has exposed deep vulnerabilities in hospital cybersecurity. These breaches don’t just threaten patient privacy; they disrupt critical care and put public trust on the line. Below, we’ve compiled several major medical cybersecurity […]

Continue readingMASSIVE DATA BREACH ALERT: 184 Million Accounts Exposed! Facebook, Google, Government Emails & More Found Unsecured. Is YOUR Data at Risk?

A shocking discovery has put millions on alert. Cybersecurity researcher Jeremiah Fowler recently found an unencrypted online database containing over 184 million account records, left wide open for anyone to access. This isn’t just another data leak; it’s a treasure trove for hackers. What Was Exposed? The 47GB database included highly sensitive personal information: User […]

Continue readingCongratulation! Lydsec Digital Technology Named as Rainmaker & Mr. Popularity for Innovation!

Lydsec Digital Technology Co., Ltd. joined the 2019 StartUp@Taipei Demo Day, held by the Department of Economic Development Taipei City Government, from 12th to 17th of November 2019. The judicators of this event included Sunsino Venture Group, Taipei Angels Investment, ABICO Group, Amazon AWS and more than thirty specialists from different industries. It is our […]

Continue readingCongratulation! Lydsec Digital Technology Made to the Final Top 10 in 2010 AWS Cloud Challenge!

Advised by the Small and Medium Enterprise Administration (MOEA) and co-organized by Industrial Technology Research Institute (ITRI), the 2019 AWS Cloud Challenge was held in Taiwan for the very first time. Differing from the usual competitors, this year it was also opened to different types of innovative companies in the fields of Artificial Intelligence, Cloud […]

Continue readingThe Institute for Information Industry Has Led Several Info Security Merchants to Join Singapore International Cyber Week (SICW) – To Show Taiwan’s Independent Development of Info Security and the Capability of Service Solutions

In order to improve the communication of domestic Info Security vendors with each other and strengthen international cooperation, the Institute of Information Industry with the support of the Industrial Development Bureau (MOEA) has selected twelve outstanding Taiwanese Info Security vendors to join the Singapore International Cyber Week from the 1st to the 3rd of October, […]

Continue readingA patented solution

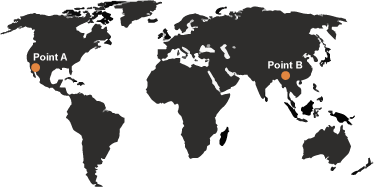

Keypasco holds several patents that are granted in most of the world’s leading IT-nations such as Korea, Japan, China, Taiwan, European Union, Singapore and the United States. Our patented features: DeviceID and two-channel authentication Bring the user’s own device as unique authentication device through a two-channel structure. Security by Your own device! Proximity The user’s own […]

Continue readingThe Keypasco Solution

Keypasco offers a unique software-based solution for secure authentication. Based on the end-user’s own device the solution provides you with your own digital identity, or as we call it – DeviceID. The foundation of the DeviceID is your device properties, location, and proximity to any external device. The Keypasco Solution simply makes sure that your […]

Continue readingSecure authentication for any online service

Imagine you could upgrade the security for 100% of your online customers without changing and complicating the user experience. Keypasco offers a software-based authentication solution that is easy to integrate into your existing systems. The quick installation can be done with our silent enrolment to instantly secure the digital identity of your customers. The Keypasco […]

Continue reading